Risk Reward in Trading The Complete Guide for Traders

These predetermined levels, which are often used as part of a disciplined trader’s exit plan, are aimed to limit emotional trading to a minimum and are vital to risk management. It’s fair to say the risk/reward ratio https://currency-trading.org/strategies/using-pivot-points-for-predictions/ is one of the most important things you should use if you want to become a successful trader. It helps you calculate your losses and profits and gives you another reason to think twice before opening a trade.

Short squeezes can introduce a lot of volatility into stocks and send share prices sharply higher. These squeezes offer opportunities for trading, but they often require different strategies and more caution than traditional breakouts. Successful trading relies on having good information https://trading-market.org/broker-legal-definition-of-broker/ about the market for a stock. Price information is often visualized through technical charts, but traders can also benefit from data about the outstanding orders for a stock. The risk/reward tool in Trading View has been very helpful in formulating and refining my strategy.

Step 1: calculating the RRR

A high win rate means the trader consistently makes profitable trades and doesn’t need to rely as heavily on big winning trades. Accordingly, the trader can afford to use a lower and safer risk/reward ratio, which can still be profitable because the trader is winning more often. Risk reward ratio is important for some traders as they use it to make decisions about whether to enter or https://forex-world.net/strategies/pro-trader-strategies-review/ exit a trade. Whether risk reward ratio is an important factor for you would depend on your trading strategy and goals. A take-profit (TP) level, on the other hand, is a predetermined price at which traders end a profitable position after they are satisfied with the amount. The risk-reward relationship helps determine whether the expected returns outweigh the risk and vice versa.

A no-fail trade? Bitcoin traders who dollar-cost average are profitable – Cointelegraph

A no-fail trade? Bitcoin traders who dollar-cost average are profitable.

Posted: Mon, 10 Jul 2023 20:54:43 GMT [source]

Invest now with Navi Nifty 50 Index Fund, sit back, and earn from the top 50 companies. Here is another video I recently made where I show the connection between the RRR and winrate again. Have you ever seen a stock exhibiting normal trading behavior and then all of a sudden the stock price drastically drops out of nowhere? This type of price action could be related to the announcement of a shelf offering or the execution of an “at-the-market” sale from… At the end of the day, all of us are in this ‘game’ to make money. If a textbook theory not properly expounded or used in conjunction with other equally

important strategies, then it’s just a textbook theory.

Level 1 vs. Level 2 Market Data

The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. In trading, we can rely on a bunch of different entry signals. In the case of trading with RSI, our Take Profit should be near the closest resistance line, which is $1833. First, you need to look for a trade that catches your attention. We spotted a divergence on the RSI and assumed gold should rise.

This is done by subtracting your market entry from your stop-loss order. When you’re done with risk, then calculate the reward by subtracting the take profit order from market entry. This may be accomplished in various ways, one of which is by implementing a risk/reward ratio designed for success. And it’s like a risk reward ratio calculator, which tells you your potential risk to reward on the trade. The risk-reward ratio is a measure of potential profit to potential loss for a given investment or project. A higher risk-reward ratio is generally preferable because it offers the potential for a greater return on investment without undue risk-taking.

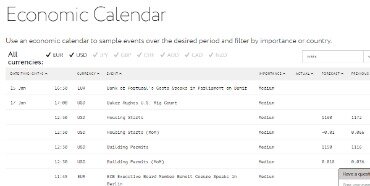

The Essential Guide to Trading Economic Events

But generally, you want to set a target at a level where there’s a good chance the market might reverse from — which means you expect opposing pressure to come in. There’s no such thing as… “a minimum of 1 to 2 risk reward ratio”. In the course of holding a stock, the upside number is likely to change as you continue analyzing new information. If the risk-reward becomes unfavorable, don’t be afraid to exit the trade. Never find yourself in a situation where the risk-reward ratio isn’t in your favor.

- We also host the international trading platform, MetaTrader 4, which is known for its endless range of indicators and add-ons that are created by users of the platform.

- The ideal is a project with a low risk-reward ratio — little risk of failure and a high potential for reward.

- As a general rule of thumb, it is wise to first address your assumed risk before turning to your prospective reward.

Also, it’s common to become fixated on achieving your desired reward even when the market signals indicate it’s best to exit an ongoing trade. This could cause you to miss out on potential profits you could have earned if you had acted on those signals instead of waiting for the price to trigger your take-profit order. You can determine your strategy’s profitability by considering your win rate. The win rate compares the number of successful trades to the total number of trades you executed. So, if out of 50 executed trades, you win 30 trades; you have a 60% win rate.

Definition of Risk/Reward Ratio

In short, the RR ratio assists traders in determining whether a particular trade is worthwhile. We also host the international trading platform, MetaTrader 4, which is known for its endless range of indicators and add-ons that are created by users of the platform. Trading with MT4 includes an algorithmic system for faster and more seamless execution, which is important when trading in volatile and risky markets. Many users have already created risk/reward indicators for the MT4 software, which help to calculate the ratios automatically as traders decide where to enter and exit a position.

I always tell people RRR is not something you can use as a singular matrix; must be combined with winning rate. If you’re trading chart patterns, then your stop loss should be at a level where your chart pattern gets “destroyed”. If the price is below the 200-period moving average such as 10-day, 20-day, or 100-day, look for short setups. In fact, you’re probably ahead of 90% of traders out there as you clearly know what’s not working. So… you’ve learned how to set a proper stop loss and target profit. Because in the next section, you’ll learn how to analyze your risk to reward like a pro.

I personally dislike “textbook” theories and concepts which have been over-used such that

they become cliches but do not work well in real life. A level is more significant if there is a strong price rejection. When you enter a trade, you want to have little “obstacles” so the price can move smoothly from point A to point B.